In today’s global finance sector, transaction link latency has emerged as a critical challenge impacting customer experience and regulatory compliance. Financial institutions worldwide grapple with the growing prevalence of network ‘jitter,’ which introduces delays and disrupts the seamless flow of transactions.

To address the issue head-on, global telecoms leader Huawei has unveiled the ‘F5G Intelligent OptiX Network’ – a new solution to help build resilient infrastructure and accelerate the digital transformation of the finance sector.

During Huawei Intelligent Finance Summit 2023 (HiFS) on 7 and 8 June, Kim Jin, vice president of Huawei’s optical business product line, unveiled the F5G Intelligent OptiX Network solution for the financial industry.

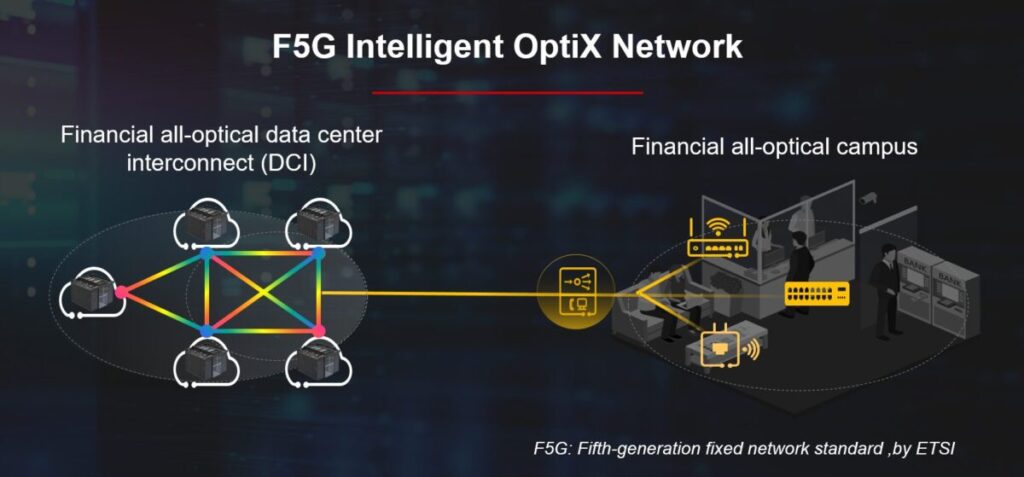

The solution aims to upgrade finance communication networks by covering financial all-optical data centre interconnect (DCI) and financial all-optical campus scenarios.

F5G Intelligent OptiX Network achieves this by utilising storage-optical connection coordination (SOCC) to prevent financial transaction failures caused by network ‘jitter’, a variance in latency, or a delay between when a signal is sent, and when it is received.

Improving the customer experience

Transaction link latency has a direct impact on customer experience. DCI network jitters have become an increasingly common issue, causing issues for the financial industry across the globe. As a result, many financial regulatory authorities have implemented requirements concerning transaction link latency and success rate.

By preventing network jitters, the new solution will ensure more stable and reliable financial transactions. Huawei’s new solution uses SOCC channels to form direct coordination between optical transmission devices and all-flash storage devices of financial DCI. The optical network can detect link faults and notify storage devices when link jitter exceeds a specified threshold.

Huawei explained that its previous solution took minutes to switch links, while the newly launched network solution can perform an I/O link switchover within two seconds – significantly shortening the financial transaction abnormality time while reducing financial transaction failures.

The financial DCI uses ‘ultra-fast’ switching within five milliseconds, as well as co-cable detection, which maintains transaction reliability.

‘Eliminate risks in campus data transmission’

During Kim Jin’s keynote speech at HiFS, he discussed the solution’s security capabilities: “Making financial data more secure is one of the core driving forces for upgrading financial ICT infrastructure. The financial all-optical DCI solution ensures high transaction reliability by using innovative technologies, such as storage-optical connection coordination (SOCC), ultra-fast switching within five milliseconds, and co-cable detection.

“And with innovative technologies such as hard pipes, the financial all-optical campus solution is able to eliminate risks in campus data transmission. These two solutions have been widely used around the world to protect financial data security.”

‘Enabling ubiquitous all-scenario financial services’

Speaking on Huawei’s goals and future ambitions, Jason Cao, CEO of Global Digital Finance at Huawei, also commented: “Huawei is committed to making strategic investments in foundational technologies to deepen its involvement in the financial industry.

“In line with this commitment, Huawei has announced four strategic directions for the financial industry: building resilient infrastructure, accelerating application modernisation, enhancing data-driven decisions, and enabling scenario innovation.

“Looking to the future, Huawei will continue exploring business scenarios and developing systematic solutions that align with the strategic directions. Our goal is to help customers build full connectivity featuring agility, experience, and collaboration, and to achieve full intelligence that is real-time, converged, and shared, enabling ubiquitous all-scenario financial services.”

In the financial industry, Huawei plans to continue working with partners and customers to develop secure, reliable, green, and efficient products and solutions. Ultimately, the telecoms leader aims to enable intelligent finance and promote further financial digitalisation.

Huawei Intelligent Finance Summit 2023 took place on 7 and 8 June in Shanghai, China. Under the theme ‘Navigate Change, Shaping Smart Finance TOGETHER’, the two-day summit witnessed Huawei’s key strategies announcement and strategic MOUs signing in the finance sector, along with its newly launched solutions. Industry leaders gathered and shared their insights on digital trends for the future of finance and successful cases. For more details, visit the Huawei website.

The post Eliminating Network Jitters: Huawei Unveils Game-Changing Solution for Seamless Financial Transactions appeared first on The Fintech Times.